First Choice Debt Solutions targets businesses and blue-collar workers to mitigate long outstanding debt and other MCA Debts while protecting your credit score, ensuring your business continues to run smoothly.

Solutions to Master

Your

Choose your debt amount - $50,000

Pay as little as

1,350+ Clients

Regain your Financial

Freedom with us!

First Choice Debt Solutions help business owners to regain control of their cash flow by eliminating bad debts to rebuilding credibility and ensuring financial stability.

Our Process

Discovery Call

Step 1

Book a free, confidential consultation with one of our Senior Debt Relief Specialists

Custom Proposal & Agreement

Step 2

Get ready to be wowed by a tailored plan that seamlessly aligns with your vision, complete with bundled services and transparent terms - no surprises, just results.

Onboarding Kickoff Meeting

Step 3

Welcome to the VIP club! Gear up for a VIP experience, complete with meeting your team, and getting a clear roadmap to operate your business with confidence and a clear head.

Strategic Planning & Setup

Step 4

Buckle up, because we're about to conduct a deep dive audit, implement a comprehensive debt relief plan, and set you up for success financial stability.

Transform Your Life and Your Business by focusing on what you do best — Growing your Business!

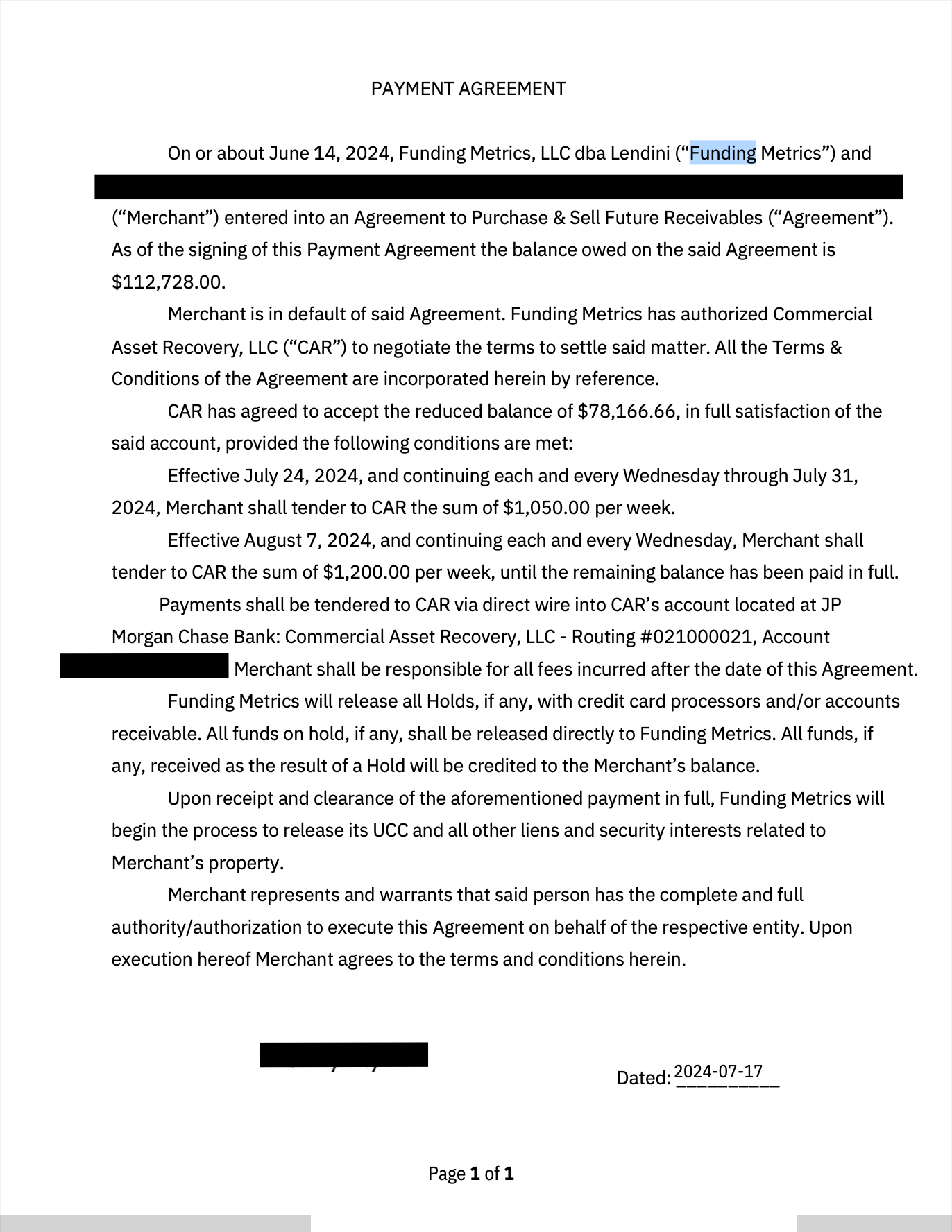

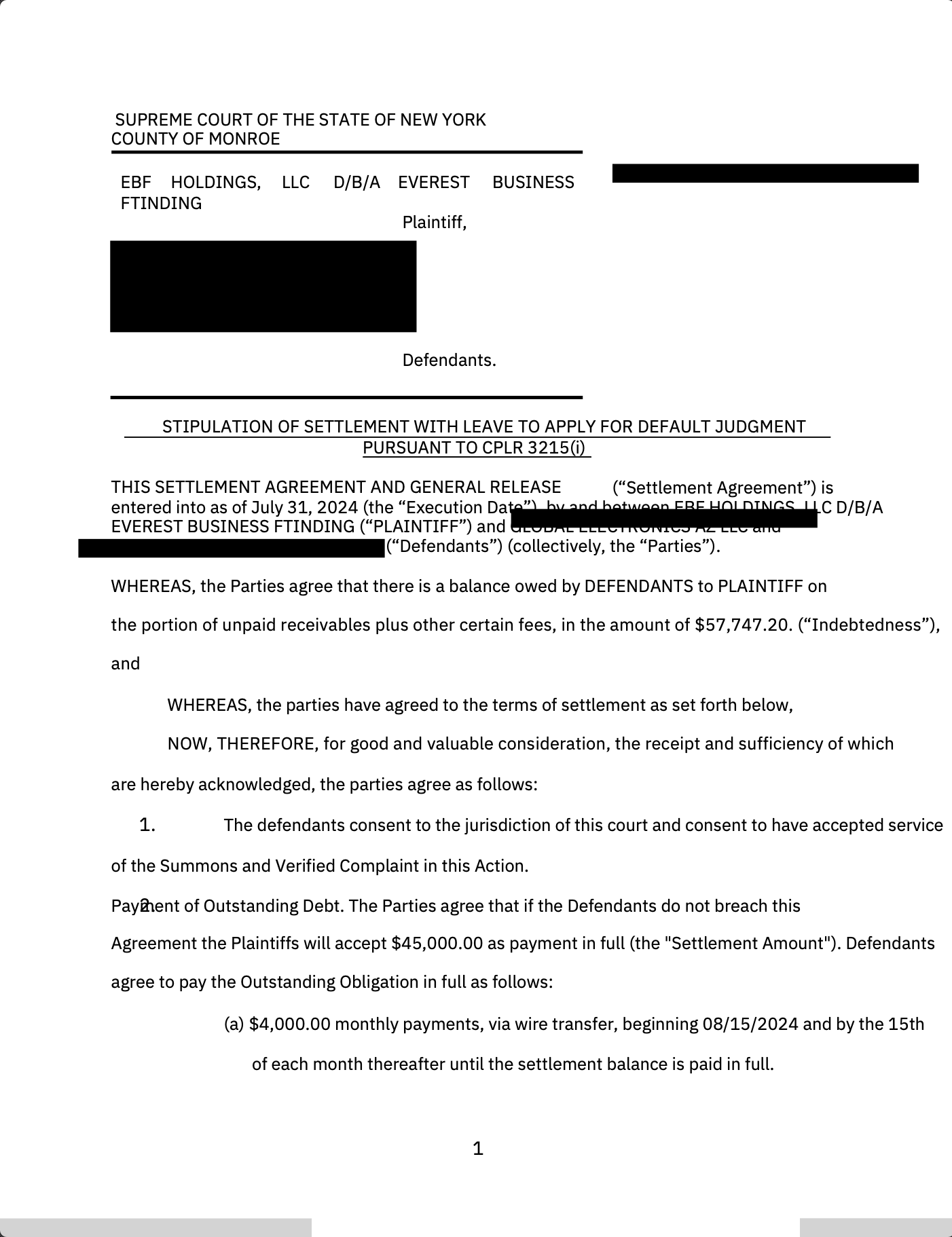

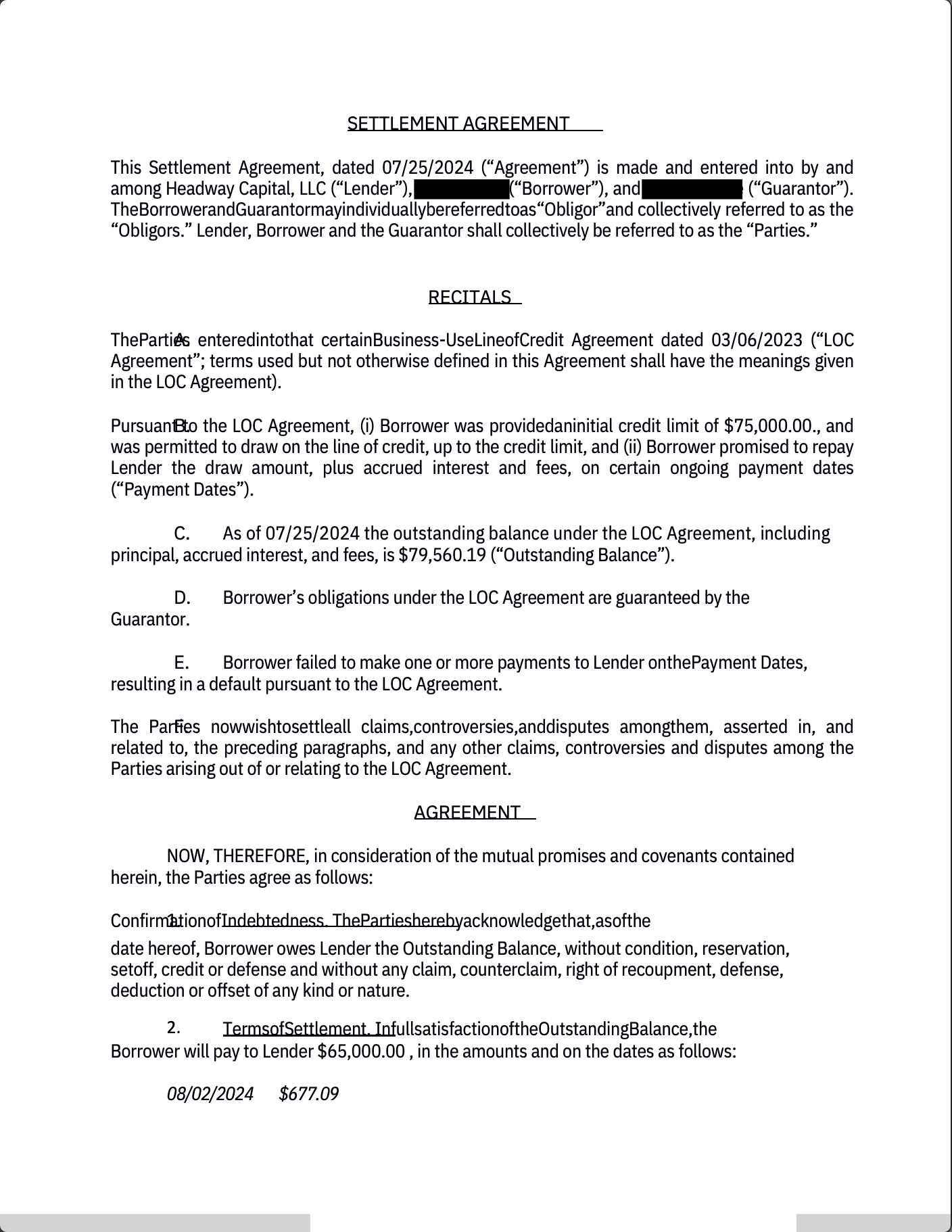

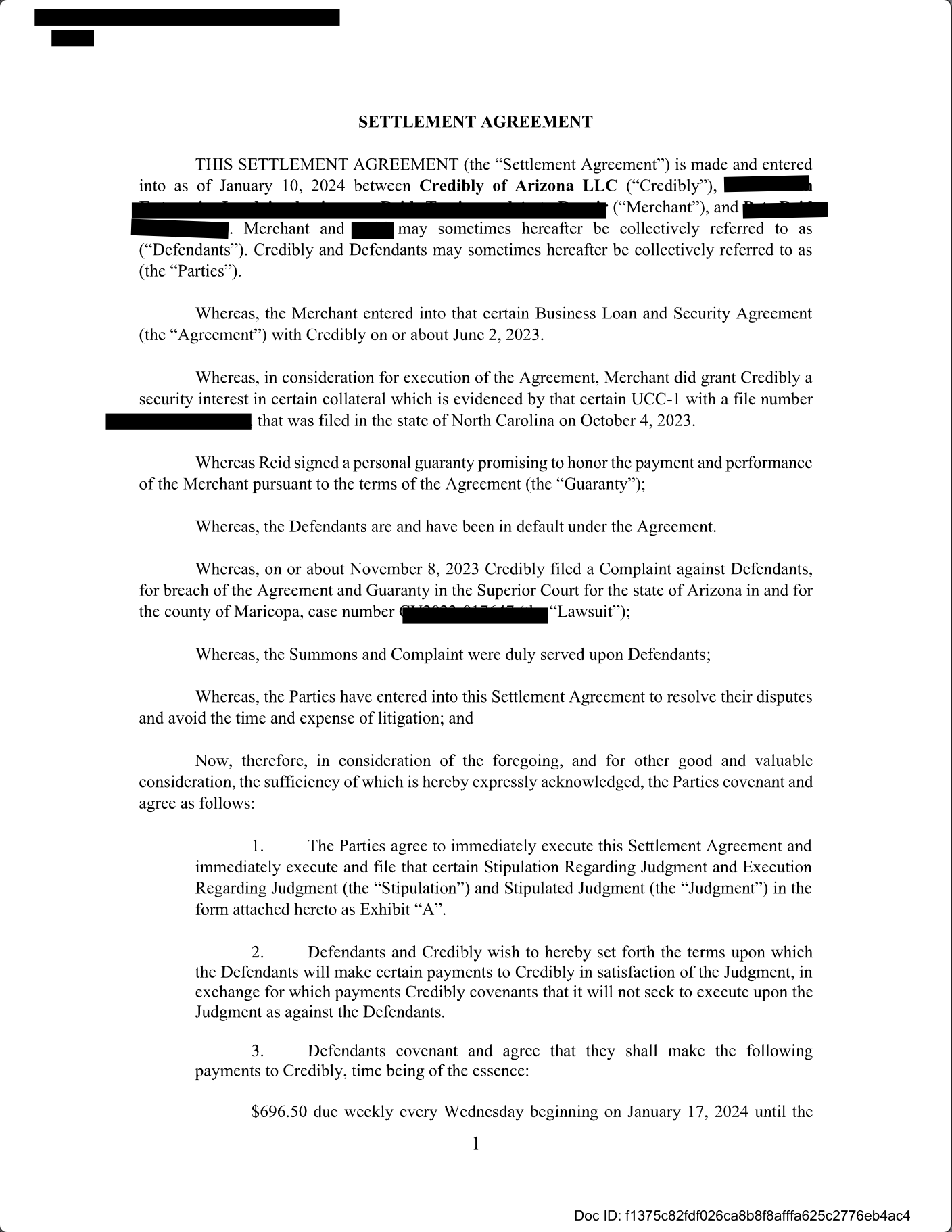

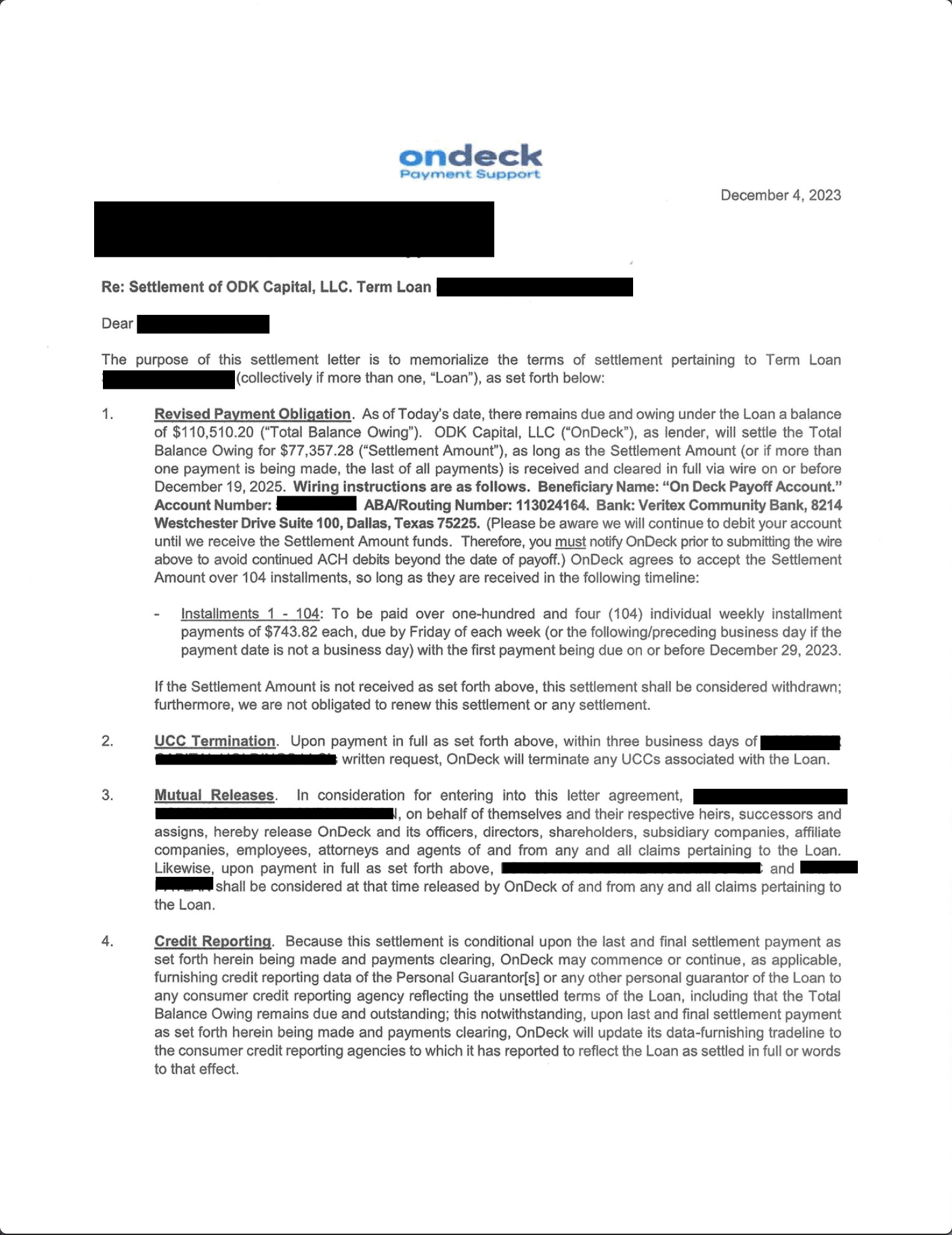

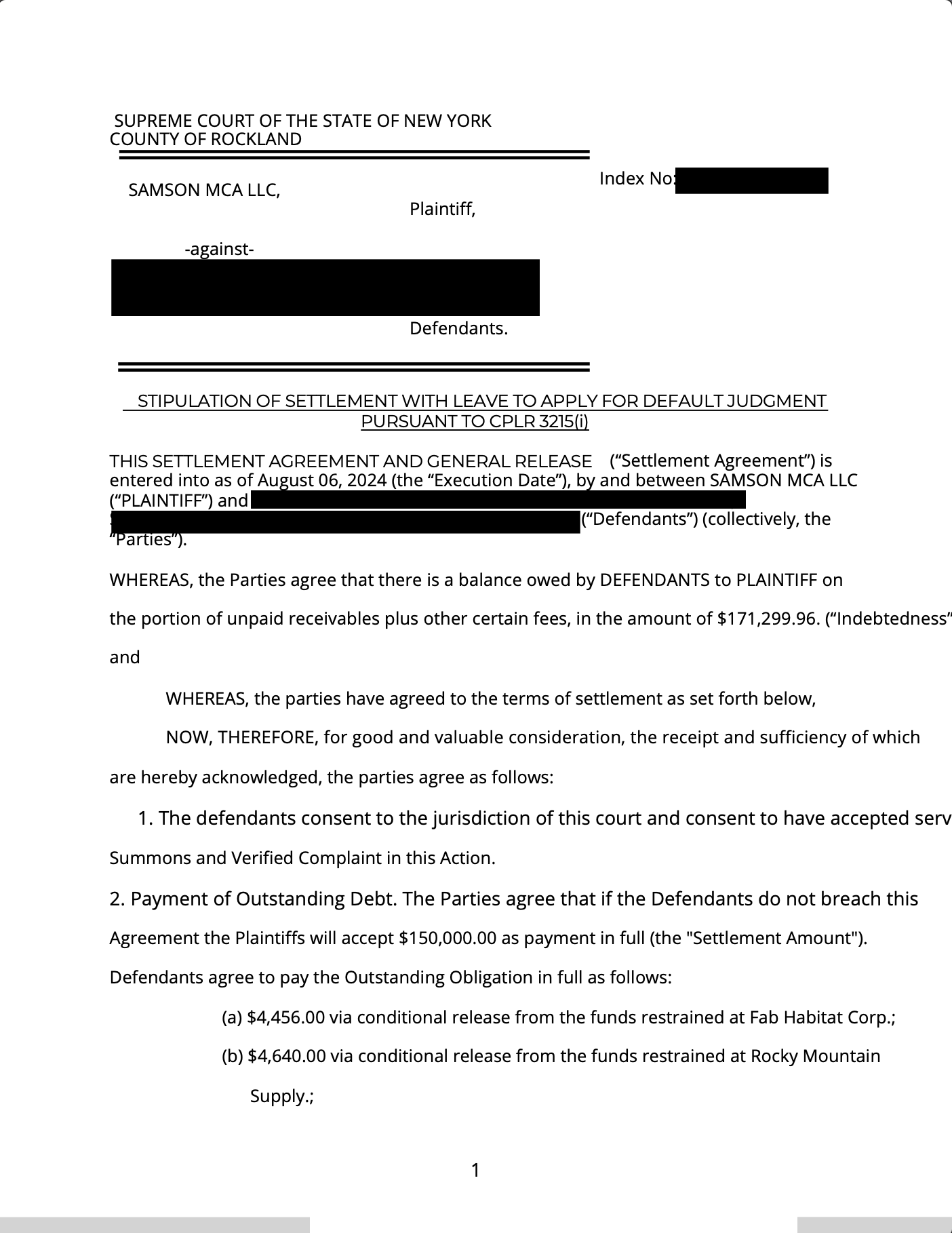

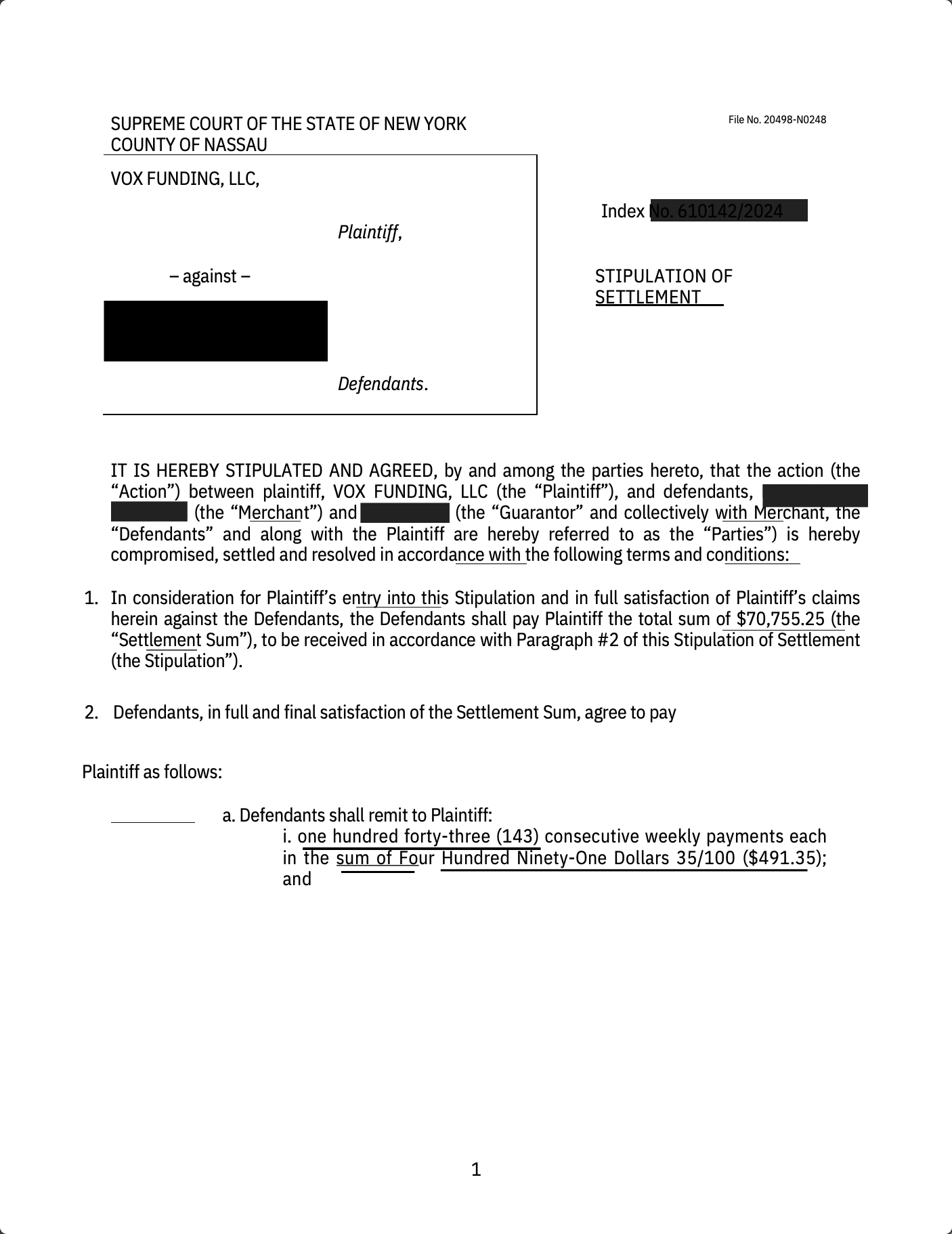

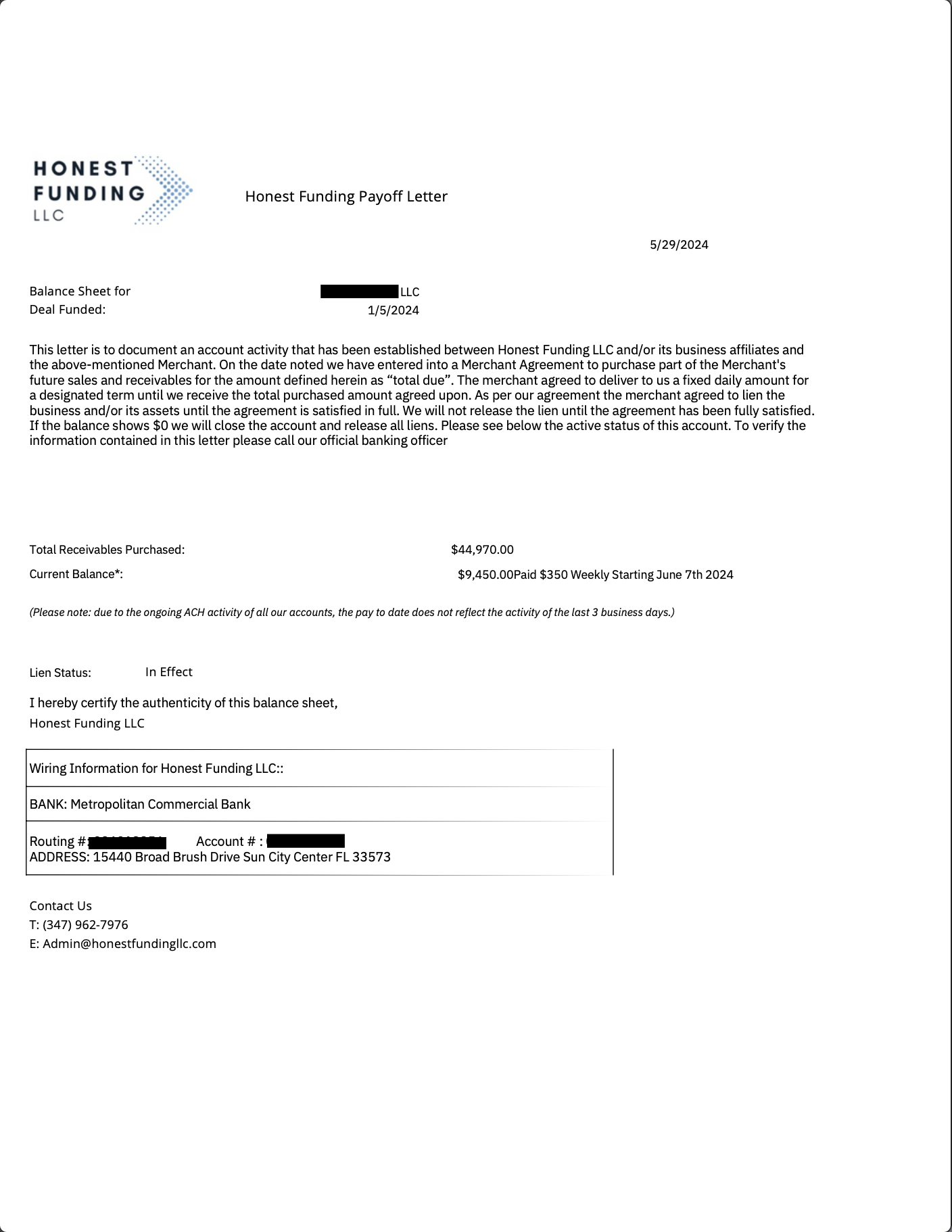

Our Recent Results

Client Results

We Serve

What Makes us Your Perfect Partner ?

Specializing in MCA debts, we convert multiple high daily payments into 1 low weekly payment for business owners of construction, trucking, restaurants, healthcare, auto repair and many more industries to get you debt free within 6-8 months

- Protect Assets

- Manage MCA Debt

- Financial Stability

Blog & Insights

Rebuilding Reputation After a Debt Crisis: Is It Possible?

A debt crisis can feel like a storm that sweeps away more than just money. For many business owners, it leaves behind something more challenging to fix: their reputation. Once vendors, lenders, and customers know a company has struggled with debt, doubts begin to rise. Can they pay on time? Can they be trusted with new deals? Will they survive another setback?

Overextended Business Credit Lines? Here’s What You Can Do

It typically starts on a high note. A company takes out a line of credit to pay for operating costs, stabilize seasonal fluctuations, or finance expansion. In the beginning, it seems like a great idea. The payments are reasonable, and the convenience is priceless. Then, disaster strikes.

How Missed Payments Start Choking Future Options

Most business owners do not set out to miss payments. At first, it is a single late payment on a loan or vendor bill. It feels small and easy to handle. But with time, those missed payments start to pile up. And before you realize it, your options for recovery get smaller and smaller.